Property taxes are local taxes that provide the largest source of money local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the value for property, ensuring that values are equal and uniform, setting tax rates and collecting taxes. Texas has no state property tax. The Legislature has authorized local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

Texas has no state property tax. The Legislature has authorized local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

Who administers the property tax system?

The property tax system consists of officials who administer the process, property tax agencies, and the laws or regulations that govern what they do.

Officials in the property tax system consist of the governing bodies (a group of officials) who oversee the operations of local property agencies also known as a taxing unit. There are several types of local taxing units, cities, county, school districts, junior colleges, and special districts who set tax rates, collect, and levy property tax to fund annual public services. Cities, county, and junior colleges have access to other revenue sources, a local sales tax. School districts rely on local property tax, state, and federal funding.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

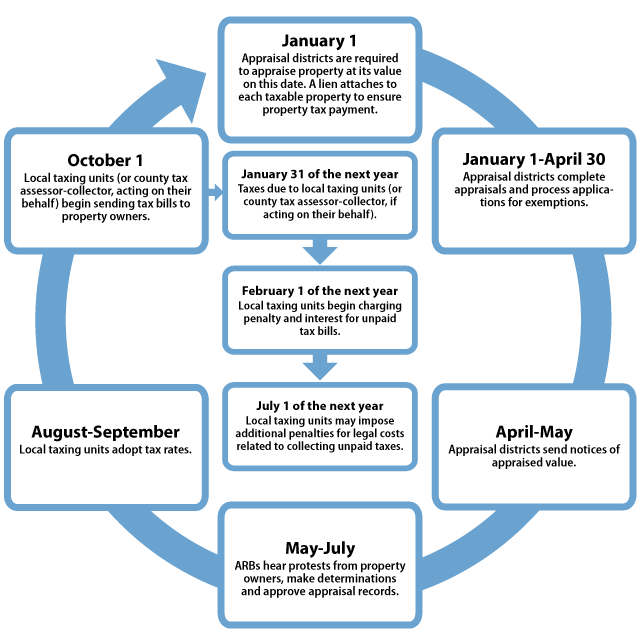

Appraisal districts, administered by a chief appraiser, appraise your property’s value as of Jan. 1 each year. Market conditions and who owns the property on that date determine whether the property is taxable, the value at which it can be taxed and who is responsible for paying the tax. The appraisal district is governed by a board of directors. Local taxing units elect the board of directors and fund the appraisal district based on the amount of taxes levied in each taxing unit. Appraisal districts process applications for tax exemptions, special agricultural appraisals and other tax relief. For more information about your local appraisal process, please contact your local appraisal district.

An appraisal review board (ARB) is a board of local citizens that hears disagreements between property owners and the appraisal district about a property’s taxability and value. The local administrative district judge in the county in which the appraisal district is located appoints the ARB members. Around May 15, the ARB begins hearing protests from property owners who either believe their property values are incorrect or were denied an exemption or special agricultural appraisal. When the ARB finishes its work, the appraisal district gives each taxing unit a list of taxable property.

In many counties, taxing units contract with the county tax assessor-collector to collect all property taxes due in that county around Oct. 1. The assessor-collector then transfers the appropriate amounts to each taxing unit. Although some taxing units may contract with an appraisal district to collect their taxes, the appraisal district does not levy a property tax. Generally, taxpayers have until Jan. 31 of the following year to pay their taxes. On Feb. 1, penalty and interest charges begin accumulating on most unpaid tax bills. For information about local taxing unit budgets and tax rates, please contact the individual school district, county, city, junior college or special district available at texas.gov/propertytaxes.

The role of the Comptroller’s Property Tax Assistance Division (PTAD) is primarily limited to an advisory role. PTAD conducts a biennial School District Property Value Study (SDPVS) for each school district for state funding purposes. The SDPVS, an independent estimate mandated by the Texas Legislature, ensures that property values within a school district are at or near market value for equitable school funding. The Comptroller’s values do not directly affect local values or property taxes, which are determined locally.

Texas law also requires the Comptroller’s office to conduct an Appraisal District Ratio Study (ADRS) to measure the performance of each appraisal district in Texas. Preformed every two years, this study measures the uniformity and medial level of appraisals performed by an appraisal district within each major property category.

PTAD also performs Methods and Assistance Program (MAP) reviews of all appraisal districts every two years. The reviews address four issues: governance, taxpayer assistance, operating standards and appraisal standards, procedures and methodologies. PTAD reviews approximately half of all appraisal districts each year. School districts located in counties that do not receive a MAP review in a year will be subject to a SDPVS and ADRS in that year.

What is a property tax?

Property tax is a tax that is measured by the value of the property a taxpayer owns. It is also called ad valorem tax, a Latin phrase that means “according to value”. The tax consists of two parts; a base amount, against which the tax is imposed; and a rate, a percentage that determines the amount of tax due.

More than 4,796 local governments in Texas — school districts, cities, counties and various special districts — assess property tax to fund local public services.

Several types of local governments may tax your property. Texas counties and local school districts tax all nonexempt property within their jurisdictions. You also may pay property taxes to a city and to special districts such as hospital, junior college or water districts.

The governing body of each of these local governments determines the amount of property taxes it wants to raise and sets its own tax rate. Many, but not all, local governments contract with their county’s tax assessor-collector to collect the tax on their behalf.

When do they do it?

The property tax process for each tax year includes a series of steps.

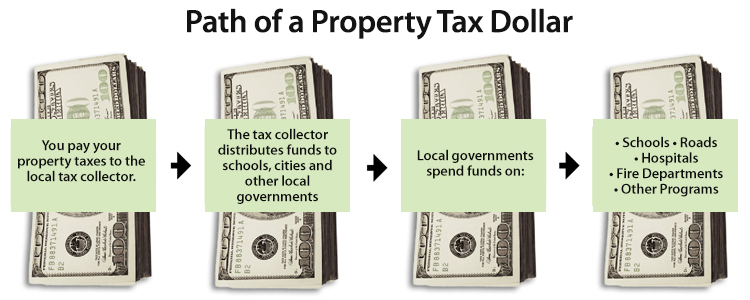

Where does the money go?

The local property tax is the largest single funding source for community services. State government receives no benefit from these local taxes. Your local property taxes help to pay for your public schools, city streets, county roads, police departments, fire protection and many other vital programs.

Why do they do it?

The Texas Constitution sets out five basic rules for property taxes in our state:

- Taxation must be equal and uniform. No single property or type of property should pay more than its fair share. The property taxes you pay are based on the value of property you own less any exemptions applied. If, for instance, your property is worth half as much as the property owned by your neighbor (after any exemptions that apply), your tax bill should be one-half of your neighbor’s. This means that uniform appraisal is very important.

- Generally, all property must be taxed based on its current market value. That’s the price it would sell for when both buyer and seller seek the best price and neither is under pressure to buy or sell. The Texas Constitution provides certain exceptions to this rule, such as the use of productivity values for agricultural and timberland valuation. This means that the land is taxed based on the value of what it produces, such as crops and livestock, rather than its current market value. This special valuation lowers the tax bill for such land.

- Each property in a county must have a single appraised value. This means that the various local governments to which you pay property taxes cannot assign different values to your property; all must use the same value. This is guaranteed by the use of appraisal districts.

- All property is taxable unless federal or state law exempts it from the tax. These exemptions may exclude all or part of your property’s value from taxation.

- Property owners have a right to reasonable notice of increases in their appraised property value.

Broad questions about the nature and purpose of property taxation in Texas can be directed to your local state representative or senator. Contact information for all members of the Texas Legislature can be found at Texas Legislature Online.

How can I challenge what they do?

If you are dissatisfied with the results of a decision by your local ARB, you have the right to appeal its decision to district court in the county where the property is located. Alternatively, you may appeal the ARB’s determination to binding arbitration or to the State Office of Administrative Hearings (SOAH) provided certain criteria are met.

Binding arbitration is conducted by an independent third party. The Comptroller’s office maintains a registry of qualified arbitrators and processes requests for arbitration and accompanying deposits, but plays no other role in this process.

If the property value as determined by the ARB order is over $1,000,000, you may file an appeal with SOAH. The decisions of SOAH administrative law judges are final and may not be appealed. For more information on this process, visit the SOAH website.

Who do I contact if I want to file a complaint against the ethics or professional conduct of a chief appraiser, appraiser, tax assessor-collector (TAC) or county TAC?

You can file a written complaint with the Texas Department of Licensing and Regulation (TDLR). TDLR regulates the registration and professional conduct of persons in the appraisal occupation. You may contact TDLR by calling 800-803-9202, or by mail at:

P.O. Box 12157

Austin, Texas 78711